PhD, Nguyen Trung Truc

Faculty of Finance and Accounting, Nguyen Tat Thanh University

Abstract: Depreciation of fixed assets is the calculation and allocation of the original cost of fixed assets to production and business expenses in order to recover the initial investment capital. In Vietnam, according to Circular No. 45/2013/TT–BTC, dated April 25, 2013 of the Ministry of Finance, there are three methods of calculating depreciation: straight-line depreciation, declining balance adjusted and amortized according to output. The straight-line depreciation method is currently being widely applied in Vietnam. However, the straight-line method of depreciation, as guided in Circular 45/2013/TT-BTC, is different in accordance with International Financial Reporting Standards (IFRS) and GAAP (General Accepted Accounting Principles). This will result in different costs and prices, making pre-tax profits and corporate income tax (DN) different. Specifically:

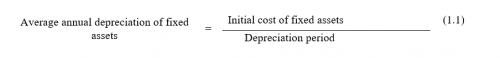

1.1. According to current regulations of the Ministry of Finance

According to Circular No. 45/2013/TT–BTC, dated April 25, 2013, of the Ministry of Finance, the straight-line depreciation method is as follows:

Initial cost of fixed assets = Actual purchase price + Import tax + Cost of transportation, installation and test run.

Depreciation period: The economic life of the asset

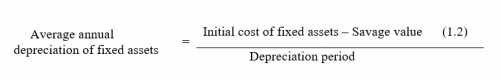

1.2 According to IFRS (International Financial Reporting Standards) and GAAP (Generally accepted accounting principles):

According to the provisions of International Financial Reporting Standards (IFRS) and GAAP (Generally Accepted Accounting Principles), which are widely applied in developed countries around the world, the amount of depreciation according to the straight-line method used to calculate the return on investment is calculated as follows:

- Depreciation results

- 1: Result of calculating depreciation expense ousing a straight line method, according to the guidance of the Ministry of Finance (VN)

Example 1: At an enterprise X buys 100% new assets with the invoice price excluding value-added tax of 200 million VND, import tax of VND 10 million, installation cost of 12 million VND, cost of testing 8 million VND, economic life period of the assets is10 years, savage value in the 10th year is 15 million VND. Corporate income tax 20%

Based on formula 1.1, the amount of depreciation using the straight-line method is calculated as follows:

The average annual depreciation rate of fixed assets is 23 million VND

The annual amount of depreciation and return on investment are shown in Table 2.1

Table 2.1 Calculation of annual depreciation (Unit: million VND)

Thus, at the end of the asset’s use of life (Year 10), the total amount that the enterprise recovers the investment capital is 242 million VND, including the depreciation amount of 230 million VND (23 * 10) and the amount of after-tax savage value recovery is 12 million VND {15*(1-20%)}.

As a result, the enterprise recovered capital compared differs from the initial investment with the excess amount of 12 million VND, making the determination of costs, costs, profit before tax and annual corporate income tax inaccurate.

2.2 The straight-line method of depreciation, as specified by IFRS and GAAP

The amount of depreciation using the straight-line method prescribed by IFRS and GAAP in formula 1.2 to recover the investment in example 1 is calculated as follows:

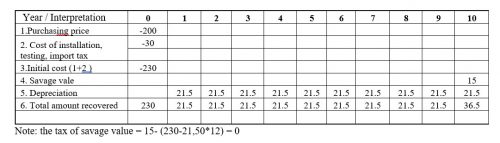

Table 2. 2 Calculation of annual depreciation (Unit: million VND)

According to the straight-line method of depreciation as prescribed by IFRS and GAAP, the return on investment at the end of the asset’s life (Year 10) is 230 million VND and it equals the initial investment capital that the enterprise has invested in. Therefore, the determination of costs, selling price and annual corporate income tax of enterprises is accurate.

- Suggestions and recommendations

By analyzing the straight-line depreciation methods as mentioned in Sections 2.1 and 2.2 above, it is clearly that by applying the depreciation method prescribed by IFRS and GAAP, the enterprise has recovered enough initial investment at the end of the life of the asset (Year 10) which is 230 million VND. Meanwhile, the straight-line method of calculating depreciation, specified in Circular No. 45/2013/TT–BTC, dated April 25, 2013, of the Ministry of Finance, the amount of depreciation at the end of the economic life of the asset (10th year) is 242 million VND, which includes the depreciation amount of 230 million VND (23*10) and the amount of the after tax savage value is 12 million VND {15*(1-20% )}.

This is inconsistent with the nature and purpose of asset depreciation according to the provisions of IFRS and GAAP, and that makes the determination of annual costs, selling prices and corporate income tax misleading.

Therefore, the author proposes that the Ministry of Finance should consider mending Circular 45/2013/TT–BTC, dated April 25, 2013 in accordance with the provisions of IFRS and GAAP, in order to create favorable conditions for enterprises to recovery properly initial investment capital and accurate determination of annual costs, selling prices and annual corporate income tax. Using the correct way calculating depreciation helps contributing the country step by step following international financial reporting standards, and contributing to successful international economic integration.

REFERENCES

Tài liệu trong nước

01) Nguyễn Trung Trực, 2018, Giáo trình Tài chính doanh nghiệp 1, Nhà xuất bản ĐHCN Tp HCM

02) Nguyễn Trung Trực, 2018, Giáo trình Tài chính doanh nghiệp 2, Nhà xuất bản ĐHCN Tp HCM

03) Nguyễn Trung Trực, 2014, Giáo trình Tài chính doanh nghiệp 3, Nhà xuất bản kinh tế Tp HCM

05) Thông tư số 45/2013/TT–BTC, ngày 25 tháng 4 năm 2013 của Bộ Tài chính

Tài liệu nước ngoài

01) Barry J. Epstein, EvaK. Jermakowicz, 2010, Interpretation and Application of International Financial Reporting Standards, Published by John Wiley & Sons, Inc., Hoboken, New Jersey

Published simultaneously in Canada

02) Steven M. Bragg, Interpretation and Application of GENERALLY ACCEPTED ACCOUNTING PRINCIPLES by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey Published simultaneously in Canad

03) Stephen A. Ross, Randolph W. Westerfield and Jeffrey Jaffe, 2019. Corporation Finance 12th edition. Published by McGraw-Hill